Miami Fort Lauderdale Housing Market for 2013

Miami Fort Lauderdale Housing Market 2013 is definitely getting very hot. Strong demand and diminishing supply are the main reasons for increasing median sale prices for both condominiums and houses.

Miami Fort Lauderdale Housing Market 2013:

According to Miami Association of Realtors, the median sales price of Miami-Dade properties is steadily increasing: condominium prices rose 26.9 percent and the median sales price of single-family homes rose 10.9 percent compared to a year ago.

In Broward County, prices are also increasing: according to the Greater Fort Lauderdale Realtors, the median sales price increased by 17.3 percent for condos and for single-family homes the median price jumped 23.2 percent from a year ago.

Also based on sales closed during the first quarter of this year, the overall median sales price in Miami Dade County and Broward County has increased for the eighth consecutive quarter.

It seems that some of the markets hurt the most by the bursting of the housing bubble have enjoyed the biggest gains: among these markets are South Florida, and specifically Miami/Fort Lauderdale Housing Market. Of course this rise in values has also meant a sharp decline in foreclosures, since rising home prices also reduce the number of people owing more on their mortgages than their homes are worth.

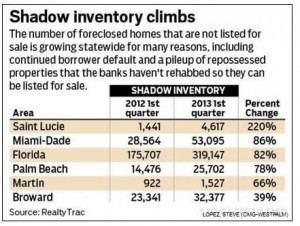

The banks are still holding inventory (Shadow Inventory:)  shadow inventory being defined as homes in the foreclosure process or bank repossessed but not listed for sale. As the shadow inventory chart shows, the number of these properties held back have almost doubled in Miami-Dade County and in Broward County it escalated to almost 40% from a year ago. The pileup in the shadow inventory is a case of banks not wanting to take a hit on distressed properties: basically banks don’t want to reduce a home’s value by 40 percent on their books and pay thousands of dollars to rehab it for sale. They are just waiting for the market to get better and therefore hoping to minimize potential losses, while holding back a large amount of inventory.

shadow inventory being defined as homes in the foreclosure process or bank repossessed but not listed for sale. As the shadow inventory chart shows, the number of these properties held back have almost doubled in Miami-Dade County and in Broward County it escalated to almost 40% from a year ago. The pileup in the shadow inventory is a case of banks not wanting to take a hit on distressed properties: basically banks don’t want to reduce a home’s value by 40 percent on their books and pay thousands of dollars to rehab it for sale. They are just waiting for the market to get better and therefore hoping to minimize potential losses, while holding back a large amount of inventory.

Miami and Fort Lauderdale real estate is also seeing a dramatic increase of foreign investments. Foreign investors really like Florida residential real estate, especially South Florida, and they are buying property sight unseen. The advancement of the internet and social media have made real estate information available on a world wide level: mainly Canada and China, but also other countries, are shopping real estate sites to find properties to buy.

An interesting phenomena is regarding Chinese investors: the rise of Chinese investors in South Florida is unique to this real estate cycle. While still being very cautious investors and preferring being under the radar, they are moving away from long standing favorites real estate markets, like San Francisco, New York and Los Angeles, and are attracted by the values and potential of South Florida properties.

Think Like a Real Estate Investor

As the housing market recovers, prices of property are quickly increasing and accordingly investors can flip properties at much higher prices in a short time.

These present times will turn out to be to be a pivoting moment of many fortunes being built and new ways of conducting real estate investing: internet, social media and foreign investments are bridging the gap among financial markets and providing new exciting opportunities.

The common strategies of wholesaling and buy and hold need to be reworked for a broader market – foreign investors and hedge funds investors are “hungry” for properties, especially in package deals. So not only rehabbers and landlords are still looking for properties to retail or keep for rental income, but buyers with great amounts of liquid funds are looking to buy large packages of properties, also know as bulk trading.

If you would like to network with other investor and keep current on the South Florida Current Housing Market, please join Laura Al-Amery at the South Florida Real Estate Club.

Upcoming LIVE Real Estate Workshop in Fort Lauderdale on June 27th at 6:30pm Take Real Estate Investing to the Next Level.

Click HERE to Register

Subscribe to our podcast

Subscribe to our podcast